Melalui e filing lhdn online termasuk borang be borang e borang borang ea. C Kegagalan menyedia dan menyerahkan Borang EA EC kepada pekerja pada atau sebelum 28 Februari 2019 adalah.

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Majikan perlu menyediakan dan melengkapkan borang EA untuk semua pekerja dan menyerahkannya.

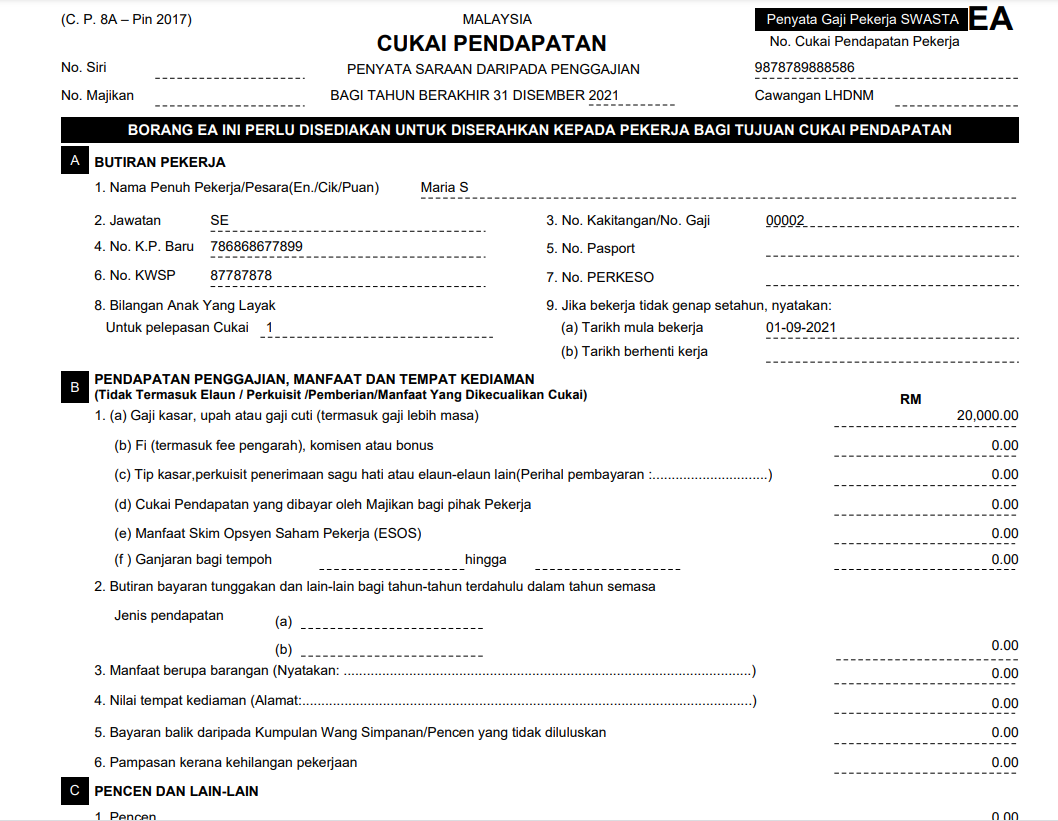

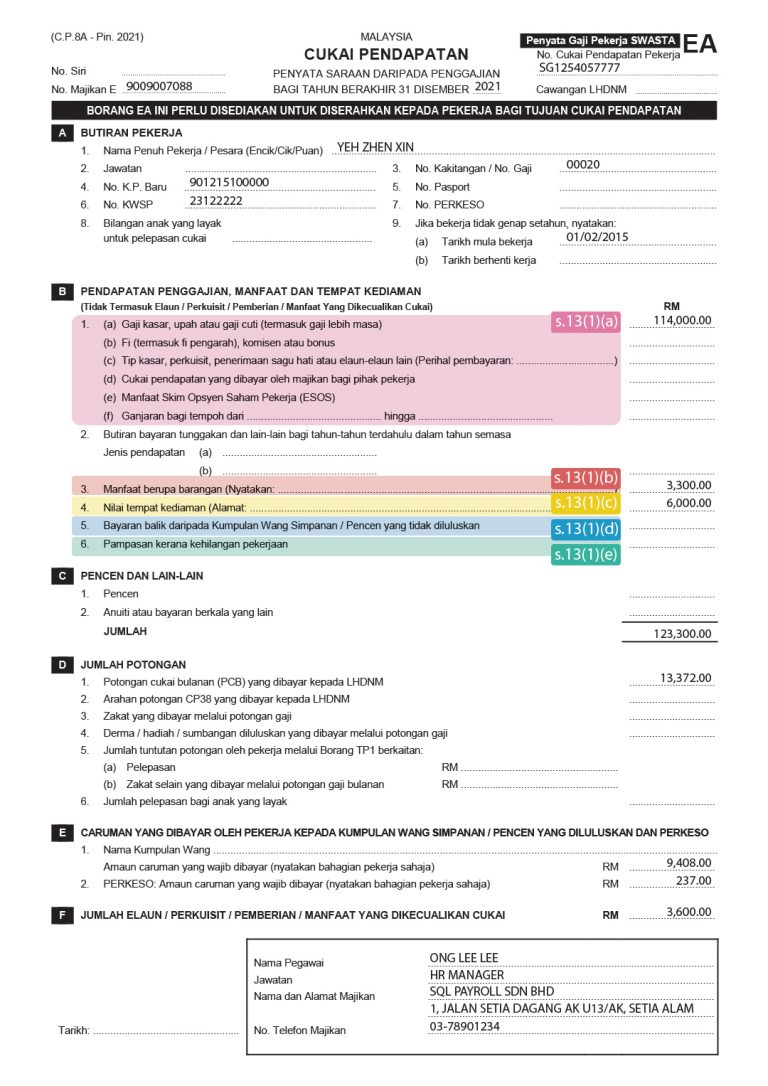

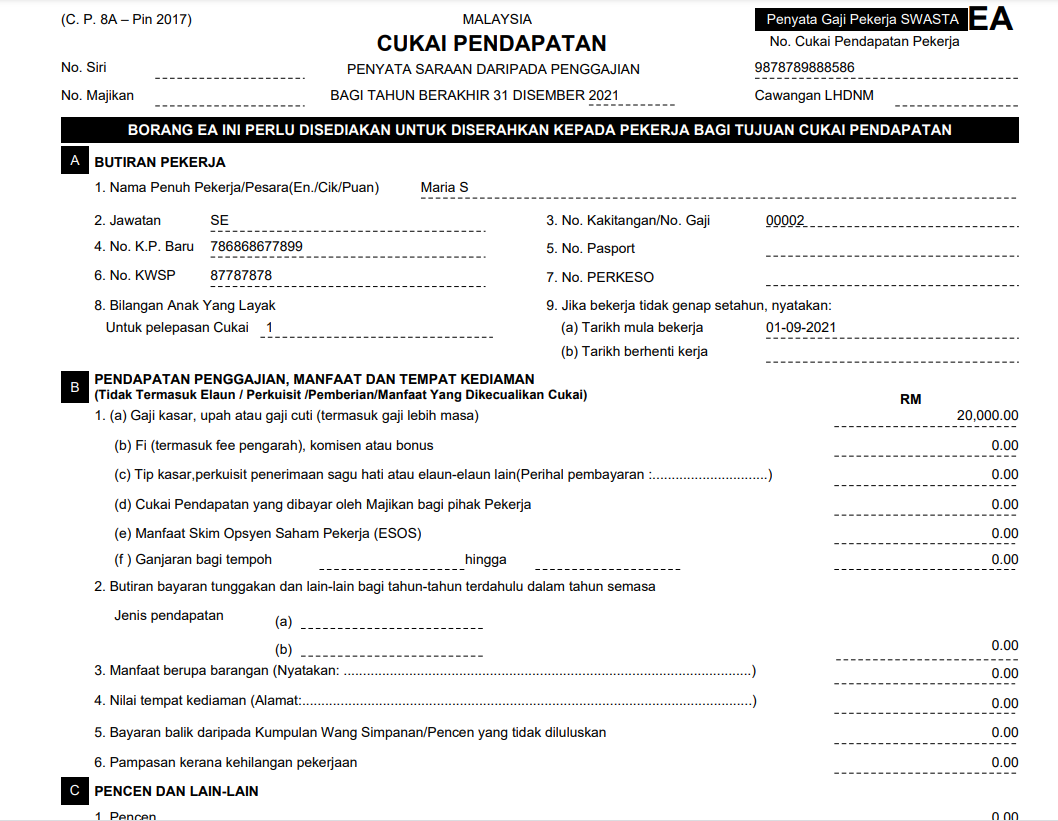

. Form E Borang E is a form required to be fill and submit to Inland Revenue Board of Malaysia IBRM by an employer. Elaun perkuisit pemberian manfaat yang dikecualikan cukai. According to the Inland Revenue Board of Malaysia an EA form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement that every employer shall prepare and render to his employee statement of remuneration of that employee before 1st March in the year immediately following the first mentioned year.

Compensation for loss of employment To assist taxpayers who have lost their jobs due to the pandemic for years of assessment in 2020 and 2021 the income tax exemption limit for compensation for loss of employment will be increased from RM10000 to RM20000 for each full year of service Employer Tax Obligation. C Bayaran tunggakan dan lain-lain bagi tahun-tahun terdahulu dalam tahun semasa Mulai tahun taksiran 2016 apa-apa pendapatan kasar daripada penggajian bagi tahun-tahun kebelakangan akan dikenakan cukai dalam tahun ia diterima. Muat Turun Layout Maklumat Praisi.

2 a Majikan yang terdiri daripada syarikat dan syarikat Labuan Syarikat Pengemukaan secara e -Filing e E adalah diwajibkan. B Majikan selain Syarikat Pengemukaan secara e-Filing e-E adalah sangat digalakkan. It includes a list of tax exempt allowances perquisites gifts benefits which are required to declare.

C Kegagalan menyedia dan menyerahkan Borang EA EC kepada pekerja pada atau sebelum 28 Februari 2022 adalah menjadi satu kesalahan di bawah perenggan 1201b ACP 1967. Every time before the tax season comes around you will see everyone scrambling around the Human Resource teams office trying to get their own. On and before 3042022.

It is used for ea tax form for malaysia rpcteal0 this report. Pilih jenis borang pada skrin e-Borang dan klik tahun taksiran yang berkaitan Senarai e-Borang. In addition every employer shall for each calendar year prepare and render to.

Klik pada pautan e-Borang di bawah menu e-Filing. Ia adalah untuk memudahkan pembayar cukai menggunakan e-Filing di mana praisi prefill telah dibuat pada borang e-Filing. A minimum fine of RM200 will be imposed by IRB for failure to prepare and submit the Form E to IRB as well as prepare and deliver Form EA to the employees.

Setelah berjaya log masuk ke sistem ezHASiL skrin Perkhidmatan akan dipaparkan 2. Aklumat melalui e-Data Praisi tidak perlu mengemukakan Borang CP8D. Majikan yang telah menghantar maklumat melalui e.

Apabila pembayar cukai menggunakan e-Filing maklumat tersebut boleh dipinda jika terdapat sebarang perubahan sebelum tandatangan dan hantar borang secara elektronik. Sharing mywave-admin Friday 22 January 2021 1305 Hits 0 Comments LHDN has released 2020 Borang E EA on 12 January 2021. C Kegagalan menyedia dan menyerahkan Borang EA EC kepada pekerja pada atau sebelum 28 Februari 2021 adalah menjadi satu kesalahan di bawah perenggan 1201b ACP 1967.

Nota Panduan Borang EA EC Nota untuk Bahagian F Borang EA Chat with us for Discount EA Form Download Links English Notes for Part F of Form EA has important information on how to fill the EA Form. Sistem ezHASiL akan memaparkan skrin eBorang seperti di bawah 3. Borang E yang lengkap hendaklah dikembalikan tidak lewat daripada 31 Mac setiap tahun.

Borang E yang lengkap hendaklah dikembalikan tidak lewat daripada 31 Mac setiap tahun. We provide version latest version the latest version that has been optimized for different devices. LHDN has released 2020 Borang E EA on 12 January 2021.

Borang E EA. How to use LHDN E-filing platform to file E form Borang E to LHDN ALL employers Sdn Bhd berhad sole proprietor partnership are mandatory to submit Employer Return Form also known as Borang E E form via e-Filing for the Year of Remuneration 2021 in accordance with subsection 83 1B of the Income Tax Act ITA 1967. A reminder on the below deadline- Borang CP8A CP8C EA EC - to all employees on or before 28 February 2021 Borang E dan CP8D on or before 31 March 2021.

As there are no changes in the format the 2017 version can be used for 2018. Borang ea lhdn 2021. Jika pembayar cukai mengemukakan Borang e-BE Tahun Taksiran 2020 pada 16 Mei 2021 BN tersebut akan dianggap sebagai lewat diterima mulai 1 Mei 2021.

Kebiasaannya digunakan oleh syarikat yang mempunyai sistem payroll dan bilangan pekerjanya adalah ramai. Borang E EA Borang E adalah pernyataan oleh majikan di bawah subseksyen 83 1 Akta Cukai Pendapatan 1967. Cara Isi Borang e-Filing Online 1.

2 Pengemukaan secara e -Filing e E adalah diwajibkan. Borang EA adalah pernyataan saraan daripada penggajian. Borang EA adalah pernyataan saraan daripada penggajian.

Borang E 2019 English Version Neue Version. Failure in submitting Borang E will result in the IRB taking legal action against the companys directors. B Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2019 adalah menjadi satu kesalahan di bawah perenggan 1201b Akta Cukai Pendapatan 1967 ACP 1967.

Download Your Free Copy of EA Form Borang EA in Excel If you have a job or have been employed before you should have come across this little piece of paper called the EA form. Borang E adalah pernyataan oleh majikan di bawah subseksyen 83 1 Akta Cukai Pendapatan 1967. Berkomputer bermaksud Borang EA EC yang digunakan oleh majikan adalah cetakan berkomputer sendiri dan bukan daripada borang yang disediakan oleh LHDN.

Borang ea yearly remuneration statement eaec form Form ea refers to borang ea ea statement ea employee is an annual remuneration statement that every employer shall prepare and disseminate.

Lhdn Borang Ea Ea Form Malaysia Youtube

Understanding Lhdn Form Ea Form E And Form Cp8d

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Form St Partners Plt Chartered Accountants Malaysia Facebook

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Index Of Blog Wp Content Uploads 2019 03

Understanding Lhdn Form Ea Form E And Form Cp8d

Lhdn Borang Ea Ea Form Malaysia Complete Guidelines

Understanding Lhdn Form Ea Form E And Form Cp8d

Understanding Lhdn Form Ea Form E And Form Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Understanding Lhdn Form Ea Form E And Form Cp8d

Malaysia Payroll Compliance How To Generate Ea Form In Deskera People

Borang Tp1 The Lesser Known Tax Relief Form Your Employer Did Not Tell You About

Ying Group 𝐍𝐨𝐭𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧 Lhdn Has Released 2020 Borang E Facebook

Ea Form 2021 2020 And E Form Cp8d Guide And Download

Income Tax Form Ea 4 Why Income Tax Form Ea 4 Had Been So Otosection